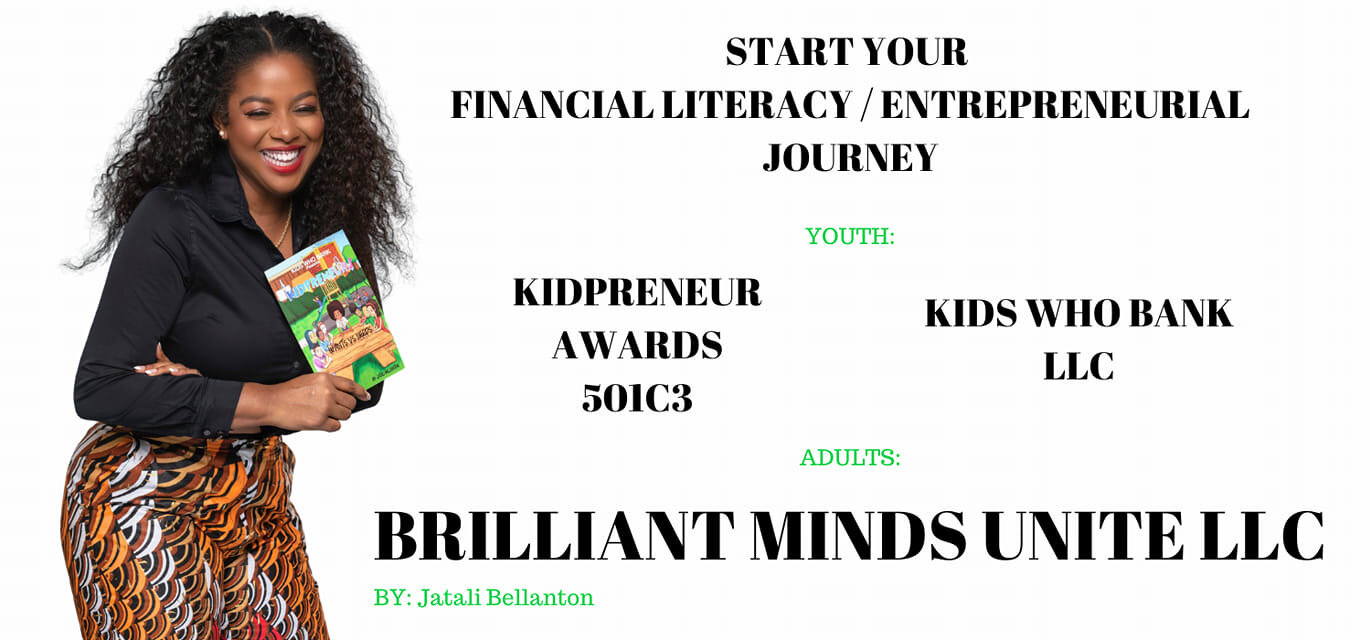

Let’s Talk Money with Jatali Bellanton

Jatali Bellanton thus far has spent 16.5 years in the finance worlds of investment banking / forensic accounting for corporate UK & USA markets helping clients make and retain millions and most recently teaching her finance curriculum in various school systems.

Making the leap from a corporate setting to becoming an entrepreneur takes courage. What was your main drive for wanting to make such a huge change after having your son?

I just wanted to be a hands on mom and did not want a stranger catching his firsts. I was raised in an environment where many of the successful people I knew in the corporate world barely saw their children during their first few years and missed a lot of important milestones like the first words or steps.

Just the idea alone gutted me. I knew if I wanted to be there I had to be as aggressive as possible to create multiple streams of income outside of that 9 to 5 environment.

.

What’re some of the struggles you’ve identified among parents raising children who may have not had a strong financially literate background?

One of the hurdles we continued to come across was parents telling their youth that something we taught them, was either not possible or not a possible reality for them. We eventually had to create the brand Brilliant Minds Unite because we realized we had to teach the adults surrounding many youth to, because they were lacking many fundamentals which impeded the growth process of the youth we wanted to help..

As a woman who educates in financial literacy, what are some hurdles that you may have faced throughout your journey in investment banking, forensic accounting and also now in your endeavors of financial literacy and outreach?

When I first started there were not a lot of networks of people who looked like me as far as mentoring went, and I was usually the token woman or token person of color or both the token woman who was the only person with Melanin, in those spaces. Which can be draining. I would walk into a room and people would think I am the secretary. However, we have come very far in today’s worlds.

My set of struggles with getting financial literacy and our financial literacy books into schools presented itself when principals asked: “Who has featured you?” or “What accolades do you have?” These questions would be asked without them even looking at our course outlines. Often times these particular locations did not even truly believe their youth were smart enough to learn the subjects surrounding, “Becoming financially healthy”, or worse, wanted me to water down our curriculum without even looking at the courses we offered. That was an annoying step that I had to work around.

There’s a lot that goes into financial intelligence from investments, to spending, to budgeting, following stocks, trading and so much more. We often hear about how hard it is to follow and understand these different areas of finances. What’re some misconceptions that you believe need to be relearned?

I think the number 1 misconception is that you have to have a certain amount of money to start. I have purchased stocks. Realistically even if you purchase a penny stock for $.30 and just allow the space to grow that is a step in the right direction. The 2nd biggest misconception is that if you save aggressively and put your money into a 401K for retirement that you will be perfectly fine. I do not agree, I think with the cost of living continually increasing you need to invest and have a healthy balance of saving and investing.

When and how would you advise starting the conversation with youth regarding financial literacy?

Once a child starts making requests which is usually around the age of 2 years old I would say they can start learning concepts like the barter system, budgeting and earning whatever it is they desire at that age. Simple: If you want to go to the park you have to clean your room or if you want to purchase a new toy then you have to learn how to read this book and I will pay you for your hard work, etc...

Your commitment to incorporating financial literacy into school curriculum is huge, and well needed. Are you planning to target primary and post secondary educational curriculum and how can school systems support this endeavor?

Thank you for the love. We have started going into the mentioned grade levels, and on a political level, discussing how we can make it a mandatory part of schools nationwide and how we- (Kids Who Bank) can help with that transition. We definitely need a lobbyist to help with our fight, but schools can help by bringing our programs in and others like mine to help with the transition. As well as

signing petitions requesting for that reform and the resources on how to do so.

What is a personal misconception that you’ve dismantled and would like to help others address?

I used to think that the only way I would ever be financially successful was working for someone else and my failures or success in those settings defined what my success or failures would be on my own. I was completely wrong. As well, I used to think entrepreneurs had it easy. Entrepreneurship is hard work, worth it, but hard and when you are fighting for the survival of your own brand you will realize that sometimes you are more about that 9 to 5 life and that is perfectly fine. Just try your best to work in an environment which makes you happy and feeds who you are as a person.

Since financial literacy isn’t often taught in our communities, schools, etc, what are some free tools and resources that we should be made aware of that can cultivate better financial practices? How can we get this info out?

We have just created a Facebook group: facebook.com/groups/BrilliantMindsUnite and we will not only be posting books but websites where you can get items to help your journey, apps that are dope, upcoming workshops (free and paid). If you are looking for printing companies and things to help the marketing and branding aspects of your business and the list continues.